In the ever-changing landscape of retirement assets options, one avenue acquiring significant interest is the Gold IRA. As monetary markets continue to develop, capitalists are considerably looking for means to expand their portfolios as well as guard their retired life cost savings. This detailed Gold IRA review intends to shed light on the benefits and also dangers associated with these precious metals pension.

Knowing the Basics:

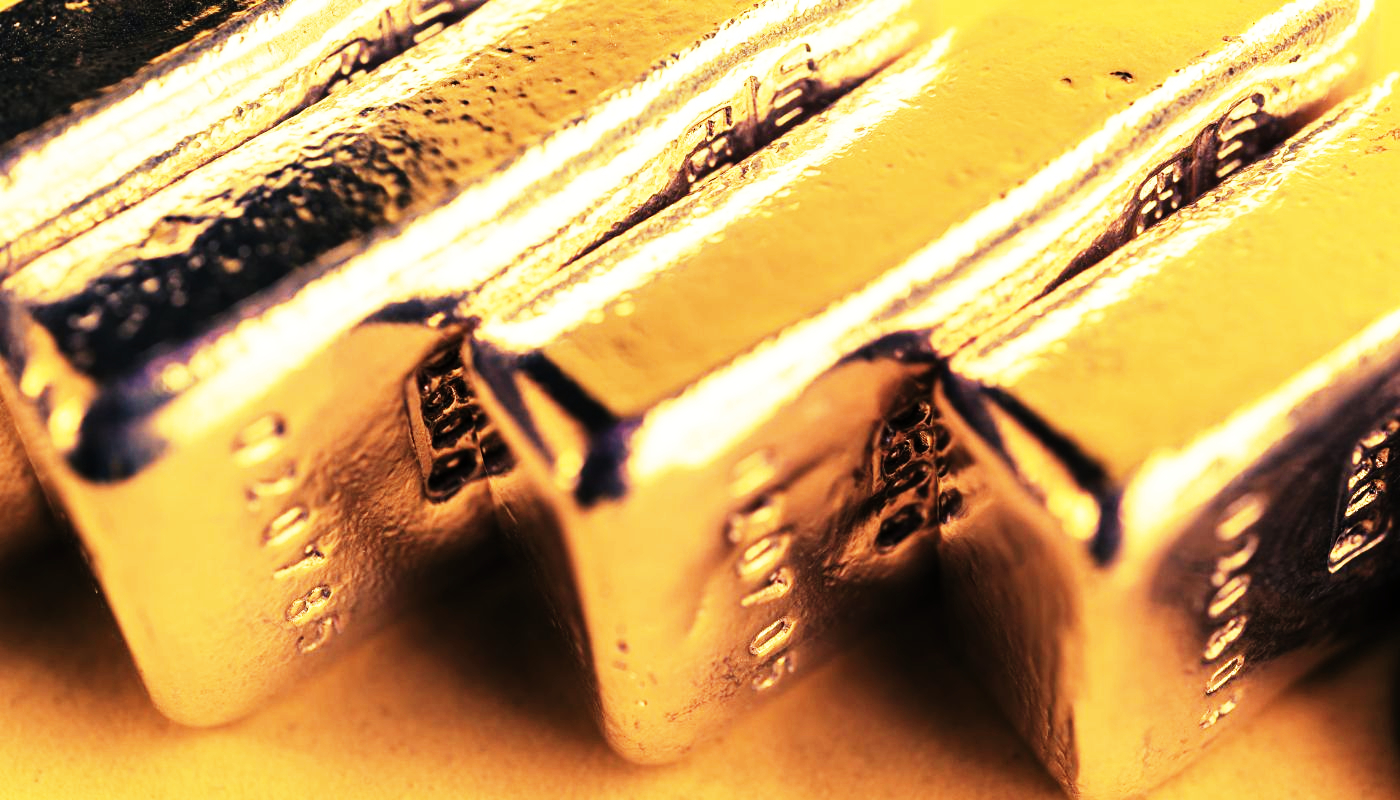

A Gold IRA, or Individual Retirement Account, is a customized financial investment lorry that permits people to include gold and silvers like gold, silver, platinum, as well as palladium within their retirement life portfolio. Unlike traditional IRAs, Gold IRAs supply an alternate resource course that is not linked to the fluctuations of the stock market.

Benefits of Gold IRAs:

- Diversification: One of the major conveniences of a Gold IRA is portfolio diversity. Metals have in the past presented a reduced correlation along with conventional properties like stocks and bonds, producing them a successful device for risk control.

- Hedge Against Inflation: Gold has actually been thought about a hedge versus rising cost of living for centuries. Unlike fiat currencies, which may lose value in time due to inflation, gold has actually sustained its own purchasing power.

- Concrete Asset Ownership: Gold IRAs allow capitalists to hold physical precious metals. This positive component provides a sense of security as well as possession, unlike various other assets autos that may be simply paper-based.

- Safe House in Times of Crisis: Precious metals, specifically gold, are actually commonly identified as safe-haven properties. In the course of economical unpredictabilities or even market slumps, gold usually tends to retain or even enhance in market value, delivering a barrier to entrepreneurs’ overall collection performance.

- Tax Obligation Advantages: Similar to traditional IRAs, Gold IRAs supply possible tax benefits. Additions may be actually tax-deductible, and capital gains within the profile are actually tax-deferred up until withdrawals are created during the course of retired life.

Dangers Associated with Gold IRAs:

- Volatility in Precious Metals Prices: While gold is frequently considered a stable expenditure, its own prices can easily still experience significant volatility. Changes out there can impact the worth of a Gold IRA, causing potential gains or reductions.

- Storage and also Custodial Fees: Physical ownership of rare-earth elements demands secure storage space, which may possess affiliated costs. In addition, managers managing Gold IRAs typically demand costs for their solutions. It’s vital for clients to properly determine these costs to ensure they don’t wear down prospective profits.

- Limited Income Potential: Unlike dividend-yielding stocks or interest-bearing connections, gold and also other precious metals usually do not create profit. Capitalists relying upon normal profit coming from their retirement life financial investments might discover this facet less attractive.

- Market and Economic Conditions: The value of gold is affected through various factors, featuring economic disorders, interest rates, and also geopolitical events. Adjustments in these variables can easily influence the functionality of a Gold IRA, and real estate investors need to keep updated regarding international financial styles.

- Illiquidity of Physical Assets: While having physical gold gives a complacency, marketing or even liquidating these possessions might not be actually as simple as selling shares or even bonds. The illiquid attribute of bodily gold can easily pose challenges in the course of times when quick liquidity is needed.

Methods for Mitigating Risks:

Provided the prospective dangers linked with Gold IRAs, clients may embrace certain methods to relieve these challenges and optimize the benefits:

- Continuous Monitoring: Stay informed concerning market styles, financial signs, as well as geopolitical occasions that may determine the worth of precious metals. Routinely reassess your financial investment method based upon altering disorders to make enlightened decisions.

- Diversification within Precious Metals: While gold is actually usually the emphasis of Gold IRAs, take into consideration expanding within the rare-earth elements asset training class. Designating funds to silver, platinum eagle, or even palladium can easily assist spread out risk and also capture possibilities certain per metal.

- Completely Research Custodians: Selecting a reliable and credible manager is actually vital. Evaluate their track record, cost design, and also customer reviews. Recognize the storage facilities and surveillance solutions in location to safeguard your metals.

- Cost-Benefit Analysis of Storage Options: Assess the expenses connected with different storing possibilities for physical precious metals. While protected storage is actually vital, it is actually equally vital to choose an option that lines up along with your finances and also does not unduly eat into your yields.

- Normal Portfolio Rebalancing: Periodically review as well as rebalance your Gold IRA collection in response to market changes or shifts in your general assets tactic. This guarantees that your possession allotment aligns along with your danger tolerance and also monetary objectives.

- Professional Guidance: Seek advise coming from economic experts, specifically those with know-how in metals investments as well as retirement life preparation. A professional economic specialist may deliver tailored direction based upon your distinct economic situation and targets.

- Look At Complementary Investments: To resolve the minimal earnings ability of precious metals, financiers might look at corresponding investments within their general collection. This might include dividend-paying equities, connections, or other income-generating assets.

It’s essential to note that the choice to feature a Gold IRA in your retirement technique ought to be actually based on a comprehensive understanding of your financial objectives, danger altruism, as well as the part you envision metals playing in your portfolio.

Regulative Considerations:

Real estate investors checking out Gold IRAs should additionally understand regulative suggestions and also income tax ramifications. Compliance along with Internal Revenue Service (IRS) rules is necessary to keep the tax obligation conveniences related to pension. Collaborating with a knowledgeable protector and inquiring from tax obligation professionals can easily help navigate these complexities.

Considering the ever-changing financial garden as well as the advancing attribute of expenditure options, clients should move toward the choice to consist of a Gold IRA in their retired life collection along with a well balanced viewpoint. While the possible benefits are actually attracting, the associated risks highlight the value of as a result of persistance as well as critical preparing.

Future Outlook for Gold IRAs:

The future overview for Gold IRAs is subject to several factors, featuring financial conditions, geopolitical celebrations, and also advancements in monetary markets. As international dynamics change, the part of rare-earth elements in expenditure portfolios might grow. Investors should keep attuned to these changes and also be prepped to change their techniques appropriately.

Technological Advancements and Gold Investments:

The assimilation of modern technology in financial markets has actually additionally impacted the way real estate investors interact with precious metals. Digital systems right now give options for trading and trading in gold digitally, offering a degree of comfort not formerly on call. While these improvements may certainly not substitute the charm of physical possession, they support the broader yard of gold expenditure alternatives.

Verdict:

To conclude, a Gold IRA could be a valuable addition to a diversified retirement profile, offering prospective benefits including dodging against rising cost of living, collection variation, as well as functioning as a safe haven during the course of financial anxieties. Nonetheless, it’s essential for real estate investors to become familiar with the associated risks, including cost dryness, storage expenses, and the illiquidity of bodily properties.

Like any kind of investment decision, complete research, cautious consideration of personal economic targets, and also assessment along with monetary experts are actually critical. By administering a thorough Gold IRA testimonial, financiers can easily make educated choices that align with their lasting retirement life objectives.