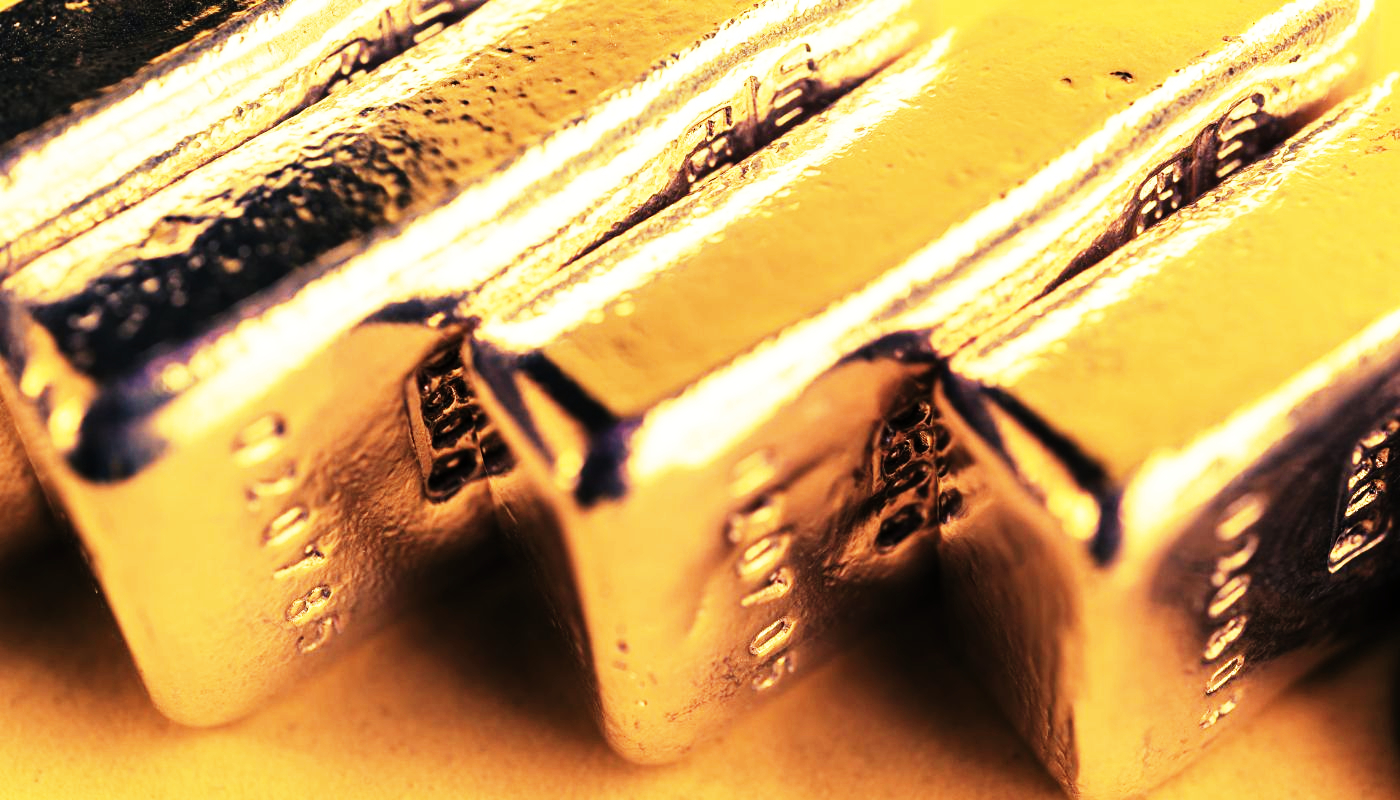

Investors are increasingly turning to precious metals IRAs to diversify their portfolios and safeguard their wealth amidst market volatility. The rising demand for these accounts has made it challenging to find the ideal gold IRA companies.

Top Precious Metals IRA Companies

As the passion in gold and also other precious metals continues to rise, numerous gold IRA firms have actually arised to deal with investors seeking a respectable companion for their rare-earth elements IRA accounts.

After substantial research as well as analysis, we’ve narrowed down the checklist of the very best gold IRA business in 2023, taking into consideration variables such as reputation, fees, customer support, and product offerings. These companies have proven themselves to be reliable and reliable companions for capitalists wanting to add a touch of gold to their retired life profiles.

Augusta Precious Metals

Augusta Precious Metals stands out as the most effective general gold IRA company, offering a clear fee structure, fair prices for all products, and an A+ rating from the Better Business Bureau. With a minimal investment of $50,000, Augusta masters providing gold and silver bullion products and also superior gold IRA rollover services, making it a suitable option for gold ira investments, including gold iras.

Nevertheless, it’s important to keep in mind the disadvantages of Augusta Precious Metals , which include a restricted product option and also a high minimum financial investment need. Additionally, the firm does not use a variety of palladium and platinum alternatives for a precious metal individual retirement account. Despite these constraints, Augusta Precious Metals stays a leading selection for financiers looking for the very best overall experience, thanks to their clear prices, excellent client service, and also life time support commitment.

Goldco

With extensive academic sources, affordable rates, and a high level of service, Goldco has gained its area as one of the very best gold IRA companies for customer assistance. The minimum financial investment required to open a gold IRA account with Goldco is $25,000, making it obtainable to a vast array of investors.

Goldco’s fees are transparent as well as straightforward. The firm also provides a buy-back program that guarantees the highest buy-back price. Among the essential attributes that sets Goldco apart is its “White-Glove Service”, which focuses on exceeding consumer expectations by accommodating their requirements, revealing real problem for their success, customizing their experience, and preemptively solving problems.

American Hartford Gold

American Hartford Gold is the ideal selection for little financiers, thanks to its reduced minimum investment demand of simply $5,000 and its dedication to consumer fulfillment. With a 4.9-star score on Trustpilot and also Consumer Affairs, American Hartford Gold has actually confirmed itself as a reliable and credible rare-earth elements IRA company.

Among the essential benefits of American Hartford Gold is its exemplary customer support, which includes a 24/7 hotline as well as substantial financier education. Nevertheless, it’s worth keeping in mind that the business has a couple of disadvantages, such as deals taking several days to clear, no online rate listing, and also shipping not being readily available outside of the United States. Regardless of these small drawbacks, American Hartford Gold continues to be a leading option for tiny capitalists looking for a trustworthy and also customer-focused precious metals IRA service provider.

Birch Gold

Birch Gold Group is the excellent option. With a solid reputation, affordable charges, and a concentrate on specific client communications, Birch Gold Group establishes itself aside from the competitors. The business uses a large product library for palladium as well as platinum, offering financiers with a broad selection of rare-earth elements to pick from.

Birch Gold Group’s charge framework is flat-rate, which is useful for those that acquire wholesale or often, yet might not be as ideal for those who purchase occasionally. The business can likewise fit custodians and also depositories that are not affiliated with them, providing succinct as well as easily offered details, especially worrying fees.

How to Choose the Right Precious Metals IRA Company

Picking the best precious metals IRA company is necessary to guaranteeing a safe and secure and also profitable financial investment experience. Variables to take into consideration when choosing a company include online reputation, costs, product offerings, and also storage options. By thoroughly assessing these aspects as well as carrying out complete research study, capitalists can make an informed choice and pick a gold IRA business that ideal matches their requirements as well as investment goals.

Reputation and Reviews

When selecting a gold investment company to deal with, it’s critical to examine gold IRA business examines and also scores from reliable sources. Favorable reviews symbolize a good customer online reputation overall, and also gaining insight from current consumers is an optimal method for obtaining knowledge regarding a gold IRA firm.

Fees and Costs

Understanding the fees associated with opening and preserving a rare-earth elements IRA is essential to making a notified choice when picking a gold IRA service provider. Costs can consist of arrangement, administrative, as well as storage costs, and also comparing these prices among different carriers can aid you discover the most affordable option for your financial investment needs.

Product Offerings

When selecting a gold IRA firm, it’s essential to assess the variety of gold, silver, platinum, and also palladium items offered by each supplier. A diverse option of precious metals can aid you diversify your financial investment profile and better safeguard your wide range from market volatility.

Storage Options and Security

Taking a look at the storage alternatives given by each gold IRA firm is a vital element of selecting the best provider. All rare-earth elements IRA financial investments need to be saved in IRS-approved depositories, and also some companies might offer set apart storage for included security.