Are you concerned about the financial stability of yourself and your family? Do you spend sleepless nights wondering who will care for you when you’re old and frail?

Given the state of the economy, it is difficult to rely on social security to provide for your care in old age. Some individuals used to scour the Internet for investment advice until they stumbled upon gold IRAs. Gold IRA investments are a significant departure from conventional IRAs.

American Hartford

American Hartford desires the globe to find out about the prospective gains that can be made from silver and also gold investments. Some people used to believe there was no safe financial investment that might cover your living costs in retired life.

Nevertheless, this firm recommends its clients on the advantages of diversifying their portfolios with rare-earth elements. Silver as well as gold bullion coins, for instance, are a fantastic method to hedge versus market volatility. You need to be alleviated to find out that the worth of your investments will certainly be steady in spite of the financial downturn.

Goldco

Goldco! It has risen to the top of the marketplace because of its capability to secure possessions from the marketplace’s volatility. Because they offer silver and gold, you might put your faith in this company. Business has come to be prominent thanks to its initiatives to simplify processes. It’s an excellent way to assist people save for the future, specifically retired life.

The firm uses outstanding brokerage solutions for precious metals IRAs. The firm likewise helps consumers transform from standard to gold IRA investments. Goldco makes use of the know-how of its financial experts to lead customers via the complex procedure of establishing a gold IRA.

Goldco facilitates its customers’ entrance into the rare-earth elements marketplace; with the help of a relied on account custodian, it takes care of all the needed formalities. It additionally helps customers established objectives as well as choose coins and also bullion appropriate to the Internal Revenue Service.

Augusta Precious Metals

Augusta Precious Metals commenced operations in 2012 and has since serviced its loyal customers by offering precious metals IRAs.

This trustworthy gold IRA firm is at the top of our checklist because of its ability to provide regular solutions, which the customers have actually deemed profoundly dependable.

Since it first opened for business in 2012, Augusta Precious Metals has been delivering precious metals IRAs to its devoted customers.

The company does not bill added charges or misrepresent the price of its things. There are no added fees past the quantity pointed out in your quote. Customers are thrilled by the company’s sincerity, despite the fact that it operates in an industry notorious for dishonest tasks.

Birch Gold

When it concerns gold IRA companies, people rely on the Birch Gold Group the most. After greater than twenty years in company, the business has actually matured, and its experience may have a significant result on your investment. Due to their experience in the field, they can persuade clients of the advantages of adding platinum, gold, silver, and palladium to their portfolios in order to diversify them.

The company’s relationships with reputable banking institutions support its ability to provide top-notch solutions. These corporations have actually permitted Birch to take advantage of modern technology to provide customized services to its clients. The firm uses monetary consultants devoted to streamlining the procedure of switching to gold IRAs for its clients.

Why You Need to Invest in a Gold IRA Company

Given the current financial climate, gold IRAs are becoming more and more popular as a form of financial investment.

If the federal government makes poor choices, it might reduce the worth of your properties. Gold Individual Retirement Accounts (IRAs) can be beneficial for hedging versus market variations.

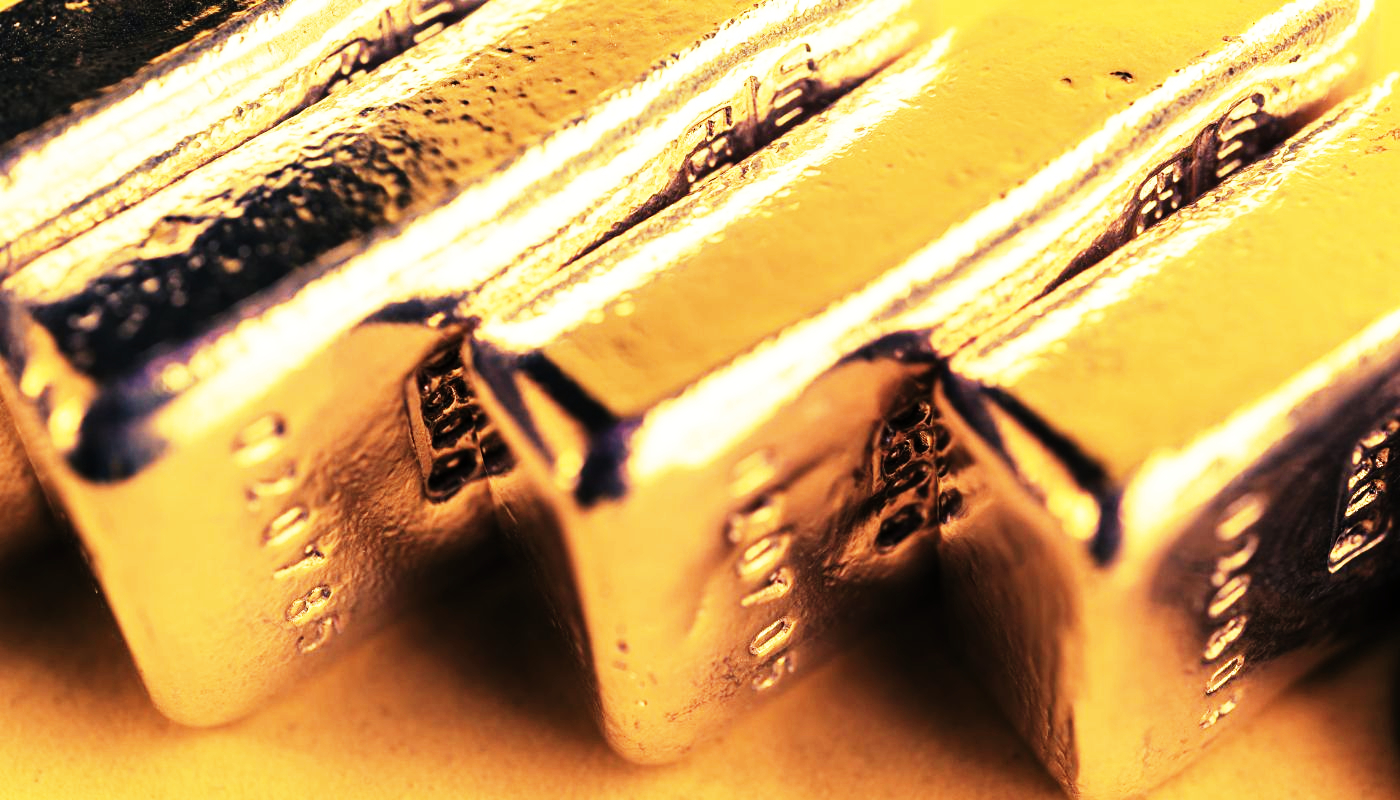

Gold is taken into consideration a more secure investment than bonds or equities. Given that it is a physical item, you can maintain it in your ownership or secure it in a safe. Gold is a wonderful long-term investment method, as long as you comply with IRS policies.

Benefits of a Gold IRA

Gold IRAs have become more popular recently as a result of their monetary advantages. Purchasing gold needs to be your initial action towards portfolio diversification. Gold’s inflation-hedging properties make it a great long-term possession for retirement savings.

The Rising Price of Gold

Lots of people reserved their retired life funds in gold given that it is a steady financial investment choice. Saving as well as investing in gold is a great way to protect retired life’s financial future. Gold is a superb financial investment considering that its rate has actually increased gradually over the past years.

Long-term Safeguard and Protection

You will certainly safeguard your retirement cost savings from market fluctuations in the long term if you put them in a gold IRA. Gold has a countertrend connection with the buck, which may come as a surprise to you. Gold’s worth increases continuously in time, whereas that of money declines. Gold financial investments are a lasting approach that might help you reach your retirement goals.

Diversifying Your Portfolio

Spreading your money out among several assets is what diversification does. Since there are no guarantees in the marketplace, it is important to keep a diversified profile to guard your cash. The technique is great for weathering market fluctuations without compromising development capacity.

Tax Benefits

A taxpayer can reduce their gross income by the amount contributed to a Gold IRA. You may keep even more of your hard-earned assets from financial investments if you owe less in tax obligations. Depending on the kind of Individual Retirement Account you have, you might have the ability to postpone or stay clear of paying tax obligations (IRA). Your tax scenario as well as salary level will determine your deductions.